Fast digital payments Nigeria: top MiniPay alternatives

Imagine you’re weaving through the bustling streets of Lagos—vendors shouting, traffic honking, every second savored yet precious. In a world that moves at the pace of a heartbeat, who has time to wait for money to transfer?

Since its launch, MiniPay has offered Nigerians a groundbreaking way to send stablecoins in seconds. But the fintech ecosystem in Nigeria is thriving, and other fast digital payments Nigeria options have emerged—each with its own vibrant story to tell.

PalmPay: The 'Super App' That Sprints Ahead

PalmPay, often described as a “super app,” caters to the masses with ease. From topping up airtime and paying bills to instant transfers and microloans, it does it all—preinstalled on Transsion phones, reaching millions before users even open the app. With 35 million users and counting, it's a true embodiment of localized fintech growth.

Flutterwave: The Payment Engine for Africa’s Ambitions

Flutterwave isn’t just fast—it’s powerful. With a central switching and processing license, it handles transactions straight from banks and fintechs, shedding intermediaries. A recognized global innovator, it’s a backbone for merchants across Africa.

Opay: Lagos’s Digital Money Lifeline

Born in Nigeria in 2013, Opay spans mobile money, POS, and banking—licensed and expanding. It’s among Nigeria’s fintech elite, known for accessibility and reach.

Kuda Bank: The Neobank Setting the Pace

Known as “the bank of the free,” Kuda brings neobanking into the hands of millions, facilitating seamless payments, savings, and heck—sometimes even payments without card details.

Kora: Bringing the Backend Magic

Kora (formerly Korapay) builds the plumbing behind pay-ins, payouts, virtual accounts, bulk disbursements—empowering businesses across Africa.

AfriGo Pay: The Homegrown Card Scheme Redefining Costs

Launched in 2023 by the CBN and NIBSS, AfriGo is Nigeria’s own card network—debit, credit, virtual cards—all affordable, naira-based, and firmly local. A direct shot at exclusivity of global card giants.

Interswitch: The Digital Gateway with Staying Power

A fintech pioneer since 2002, Interswitch powers Quickteller, Verve, and even ATM networks. It's the silent giant behind digital payments in Nigeria.

Why these alternatives to MiniPay digital payments matter

- PalmPay brings mass-market convenience with local insight.

- Flutterwave delivers robust infrastructure and licensing for seamless transactions.

- Opay integrates mobile banking with expansive reach.

- Kuda Bank channels digital banking for the unbanked.

- Kora empowers businesses with flexible pay-in/out tools.

- AfriGo Pay strengthens the national economy with affordable card schemes.

- Interswitch offers trusted, reliable back-end processing across the ecosystem.

Each plays a different role—from everyday convenience to business-grade infrastructure.

Quick note on privacy

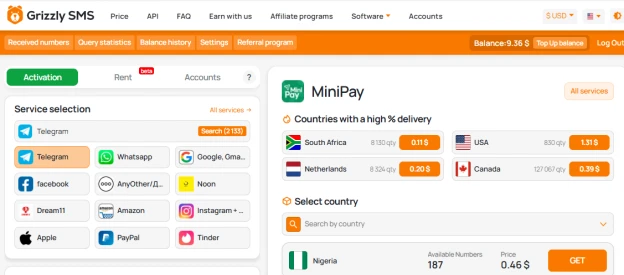

Some of these services let you register without tying your real phone number—using Nigerian virtual numbers for MiniPay via Grizzly SMS as a disposable contact. Handy for testing or maintaining extra privacy.