Best Ways to Use PayPal in Nigeria Without Account Freezes

For many Nigerians, PayPal is more than just a payment platform — it’s a bridge to the global economy. Freelancers rely on it to receive payments from clients abroad, shoppers use it to buy from international stores, and small businesses leverage it to expand beyond borders.

But there’s a recurring nightmare: account freezes.

Waking up to see your PayPal account marked “Limited” or “Frozen” is not only frustrating — it can lock your funds for months. While PayPal’s security system is designed to protect users, Nigerian accounts often face extra scrutiny due to the country’s high fraud-risk rating.

The good news? By setting up your account properly and following best practices, you can greatly reduce the chances of PayPal restrictions.

1. Start With a Fully Verified Account

The safest PayPal account is one that’s completely verified.

- Use accurate, real information that matches your legal documents.

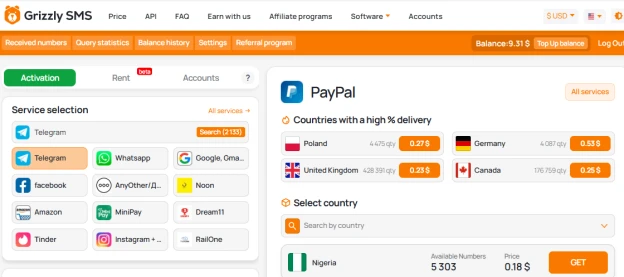

- Link a valid email and phone number — if you value privacy or your SIM struggles to receive international SMS codes, use a Grizzly SMS virtual number for PayPal to receive the verification instantly.

- Connect your PayPal to a working Nigerian bank account or a virtual USD card to ensure smooth transactions.

2. Choose the Right PayPal Type for Nigeria

PayPal offers two main account types in Nigeria:

- Send-Only Accounts — allow you to pay internationally but not receive money.

- Business Accounts — enable both sending and receiving, but require stricter verification.

If your goal is to receive payments for freelance work, e-commerce, or services, set up a Business Account from the start and prepare to submit all requested documents (ID, proof of address, business details).

3. Avoid Sudden Spikes in Transactions

One of the fastest ways to trigger PayPal’s fraud detection is to jump from zero activity to high-value transactions overnight.

- Start with smaller amounts and gradually increase your transaction volume.

- Keep amounts consistent — a sudden large payment without history often results in a review.

- If expecting a big payment, ask the sender to split it into multiple smaller transactions.

4. Link Reliable and Consistent Payment Methods

- Use virtual USD cards from trusted providers like Payoneer, Chipper Cash, or Eversend.

- Ensure the name on your PayPal account matches the name on the linked card or bank account.

- Avoid adding and removing multiple cards frequently, as it can look suspicious to PayPal’s security system.

5. Keep Account Activity Transparent

- If you sell goods or services, always provide tracking numbers.

- Respond quickly to any PayPal request for proof of delivery or identity verification.

- Maintain polite and clear communication — well-handled disputes are less likely to lead to account freezes.

6. Consider Maintaining a Backup Account

Some professionals keep a secondary PayPal account as a safety net in case their main account is limited.

- Do not link the same email, phone number, or bank account to both profiles.

- A Grizzly SMS virtual number is perfect for creating a separate verified account without exposing your personal number.

7. Withdraw Funds Regularly

Leaving large balances in your PayPal account for long periods can be risky.

- Withdraw to your linked bank account or USD card regularly.

- Smaller, consistent withdrawals appear more natural and reduce the likelihood of triggering reviews.

Final Thoughts

PayPal remains one of the most valuable tools for Nigerian freelancers, online shoppers, and business owners — but only if used correctly. By verifying your account properly, linking trusted payment methods, and keeping your activity consistent, you can operate without the constant fear of freezes. And with tools like Grizzly SMS, creating and maintaining verified accounts is faster, safer, and more flexible.