Best Payment Platform for Freelancers in Nigeria – PayPal or Payoneer?

It’s 11:47 p.m. in Lagos. Your client in New York just hit “Send Payment.” As a freelancer, this moment is both satisfying and slightly nerve-wracking. The money is out there in digital limbo — but how it arrives in your hands depends on the platform you choose.

In Nigeria, two giants dominate the global payment scene for freelancers: PayPal and Payoneer. Both promise to bridge continents, but they do so in very different ways.

Understanding the Basics

PayPal is globally recognized, widely accepted by marketplaces, and offers instant transfers between accounts. However, in Nigeria, PayPal withdrawal options are limited, and conversion to naira often comes with steep fees and weaker exchange rates.

Payoneer, on the other hand, focuses on cross-border business payments. It gives you a virtual USD, EUR, or GBP account, making it easier to get paid in foreign currency and withdraw through Nigerian banks with more control over exchange rates.

Payoneer vs PayPal Fees Nigeria

One of the first questions freelancers ask is about cost.

- PayPal: Charges a transaction fee (often around 4.4% + fixed fee) plus currency conversion charges, which can be 3–4% above market rates.

- Payoneer: Charges 1% for receiving USD payments from clients and $1.50–$3 for local withdrawals. Exchange rates are usually closer to market value.

Verdict: For large payments, Payoneer often means keeping more of your money.

Which is Better PayPal or Payoneer for Freelancers?

It depends on your workflow:

- Choose PayPal if your clients use platforms that only support PayPal or if you need quick peer-to-peer transfers.

- Choose Payoneer if you want better control over currency conversion, lower withdrawal fees, and multiple currency accounts.

Many Nigerian freelancers actually keep both accounts to cover all client preferences.

PayPal for Freelancers Nigeria – Strengths and Weaknesses

Strengths:

- Wide global acceptance

- Instant transfers between PayPal users

- Easy integration with major freelance marketplaces

Weaknesses:

- Limited direct withdrawal to Nigerian banks

- High conversion fees

- Some payment holds for new accounts

Payoneer for Freelancers Nigeria – Strengths and Weaknesses

Strengths:

- Multiple currency accounts (USD, EUR, GBP)

- Better exchange rates when withdrawing

- Local bank transfers in naira

Weaknesses:

- Slightly slower transfer times (1–2 days for bank withdrawals)

- Less universal acceptance compared to PayPal for small one-off transactions

Exchange Rates – The Silent Factor

In the PayPal vs Payoneer exchange rates debate, Payoneer generally offers rates closer to the real market rate. This can mean a difference of thousands of naira over multiple transactions.

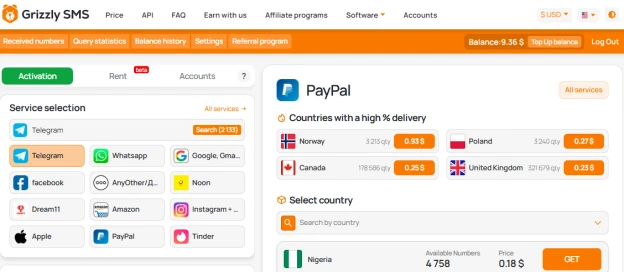

A Note on Privacy-Friendly Registration

Some services, including certain payment platforms, allow registration without a personal phone number when using tools like Nigerian virtual number for PayPay or Payoneer via Grizzly SMS. This is useful for freelancers who value privacy or want to test a service before committing.