PalmPay vs MiniPay 2025: Which Mobile Wallet Wins for Nigerians?

In a country where airtime is king and POS terminals stand on every street corner, digital wallets have become more than financial tools — they’re part of daily survival. Whether you’re sending money, paying bills, or topping up in traffic, mobile wallets like PalmPay and MiniPay are transforming how Nigeria moves money.

But in 2025, with more users going digital than ever, the question is clear: Which wallet is better, PalmPay or MiniPay?

Let’s compare them where it counts — speed, features, fees, and user experience.

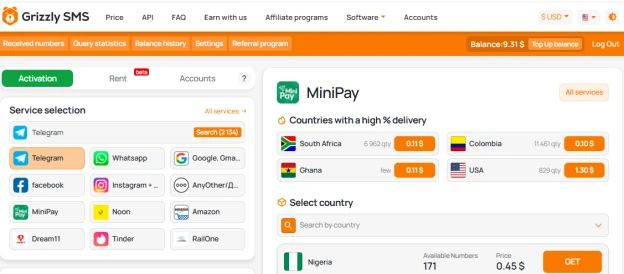

Account Creation: No Phone Number Needed? It’s Possible

You might be surprised to learn that some wallets — including those reviewed in this article — allow users to register without a personal phone number using temporary SMS services Grizzly SMS. It’s a useful trick if you're testing platforms, avoiding spam, or just trying to stay private.

MiniPay Features 2025 – Simplicity Meets Speed

MiniPay, launched by Opera, focuses on lightweight, stablecoin-based payments. Its killer feature? Speed. Transactions with cUSD settle almost instantly and cost virtually nothing.

Key advantages:

- Built into Opera Mini browser

- Works offline-friendly for low-data users

- Near-zero fees with stablecoins

- Focused on user privacy and low entry barriers

But MiniPay lacks a full suite of features: no bill payment, airtime recharge, or savings tools (yet). It’s a payment-focused solution — not a full digital bank.

PalmPay Benefits Nigeria – All-in-One Powerhouse

PalmPay plays a different game. It positions itself as the Nigerian fintech "super app" with deep service integration:

What it does best:

- Bill payments, airtime, TV, electricity

- Loan offerings and cashback rewards

- QR payment, merchant POS, and business accounts

- Frequent promos, giveaways, and loyalty programs

PalmPay is less focused on crypto or stablecoin use. Instead, it thrives on partnerships with telcos and local merchants — making it more “mainstream.”

MiniPay vs PalmPay Fees – Who’s Cheaper?

- MiniPay: Most transfers (via cUSD) are nearly free. You're only paying blockchain gas fees, which are fractions of a cent. Great for microtransactions.

- PalmPay: Local transfers may be free with bonuses, but after promo periods, charges can apply for bank or POS operations. Still affordable, but variable.

If you care strictly about cost per transaction, MiniPay wins. But PalmPay counters with rewards and cashback that often cancel out small fees.

Mobile Payment Apps Nigeria – User Experience

PalmPay

- Visually busy, but intuitive

- Feature-rich, best for multitaskers

- Can feel overwhelming to new users

MiniPay

- Ultra-simple interface

- Limited actions = faster learning curve

- Best for quick send/receive use cases

In short, MiniPay is like a bicycle: direct and efficient. PalmPay is like a bus — bigger, heavier, but more destinations.

Which Wallet Is Better: PalmPay or MiniPay?

The honest answer? It depends on your lifestyle.

- Choose MiniPay if you prioritize low-fee, cross-border, or stablecoin payments — especially if you're already using Opera Mini.

- Choose PalmPay if you want an all-in-one app with rewards, bill pay, and daily local use.

Or better yet — use both. Many Nigerians do.