Best Way to Withdraw PayPal in Nigeria With Minimal Charges

You’ve finished a freelance project for an overseas client. The PayPal notification lights up your phone — payment received. But then comes the real question: How do I get this money into my Nigerian bank account without losing half to fees and bad exchange rates?

For many Nigerians, PayPal is both a lifeline to the global economy and a source of frustration when it comes to withdrawals. The good news? With the right methods, you can keep your hard-earned cash where it belongs — in your pocket.

Understanding the PayPal Withdrawal Challenge in Nigeria

The struggle is real: high conversion fees, limited withdrawal options, and sometimes long delays. While PayPal is excellent for receiving payments, the default withdrawal path often punishes Nigerian users with high fees and poor exchange rates.

This is why knowing PayPal withdrawal methods Nigeria that bypass unnecessary costs is essential.

Best Way to Withdraw PayPal in Nigeria With Minimal Charges

Here are some proven solutions that Nigerian freelancers, entrepreneurs, and online sellers rely on:

- Linking PayPal to a U.S. Bank Account

If you can open a U.S. account — either physically or through a trusted fintech partner — you can withdraw in dollars, then use local currency exchange services at better rates. - Using Virtual Dollar Accounts

Fintech apps in Nigeria now offer PayPal to bank Nigeria low fees by creating a virtual USD account you can link to your PayPal. You receive funds in USD, then convert when rates are favorable. - Partnering With Payment Processors

Some processors specialize in converting PayPal to Nigerian bank account deposits at competitive rates, cutting both fees and time delays.

Cheapest Way to Withdraw PayPal in Nigeria

The “cheapest” method varies depending on your transaction volume and urgency:

- For small, frequent withdrawals: consider fintech apps with low flat fees.

- For large amounts: USD withdrawal to a foreign or virtual account often gives the best exchange rate.

- Avoid withdrawing directly to naira via PayPal’s own converter unless you have no other choice — rates there are usually the lowest.

PayPal to Naira Exchange Rates: Why They Matter

Even if the withdrawal fee looks small, a poor exchange rate can silently eat a huge chunk of your funds. Always compare rates between PayPal’s default conversion and trusted third-party services before moving large sums.

Fast PayPal Withdrawal Nigeria Options

If speed matters, prioritize services known for same-day transfers to your Nigerian account. Some virtual account providers now offer near-instant withdrawals once funds land in your USD wallet.

A Note on Privacy-Friendly Registration

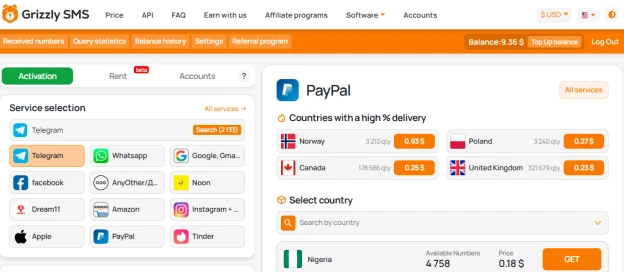

Some services that help you withdraw or convert PayPal funds let you sign up without a personal phone number by using platforms like Grizzly SMS. This can be useful if you value privacy or want to test a platform before committing fully. More about Nigerian temporary phone number for PayPal registration.